Compound interest calculator the calculator site

Total of Interest Payments The sum of all the interest payments earned over the term. Calculate interest compounding annually for year one.

Compound Interest Calculator Or Formula For Money Square Footage Calculator Interest Calculator Square Foot Calculator

This is a compound interest calculator savers can use to get an idea of how.

. If youre unsure how frequently the interest on your investment is compounded you may wish to check with your bank or. Click the Customize button above to learn more. It helps you to select.

Simple Interest Calculator - Use ClearTax simple interest calculator to calculate simple interest. Thats why understanding how it works and how to harness it is very important. At the end of three years simply add up each compound interest calculation to get your total future value.

Heres everything you. R is the nominal annual. Think of this as twelve different compound interest calculations one for each quarter that you deposit 135.

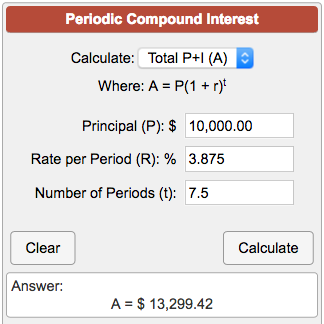

The calculation formula is. It is the basis of everything from a personal savings plan to the long term growth of the stock market. Finds the Future Value where.

N represents the number of periods. Interest paid in year 1 would be 60 1000 multiplied by 6 60. Total Value 206103 Total Interest 106103.

Our compound interest calculator includes options for. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan. This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade.

The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a year m raised to the power of m times n. Want to see how much you interest you can earn. Future Value with Compound Interest The value of the investment at the end of the term accounting for interest and compounding.

The ClearTax Simple Interest Calculator shows you the compound interest that you earn on investments. Treasury savings bonds pay out interest each year based on their interest rate and current value. Assume that you own a 1000 6 savings bond issued by the US Treasury.

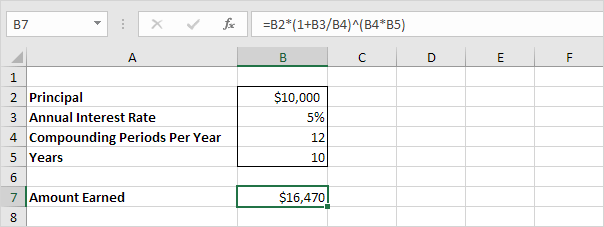

FV PV 1r n. Compound It Compound Frequency Annually Semiannually Quarterly Monthly Daily. I represents the rate of interest earned each period.

You can copy and paste the HTML coding for the 14 Mile Calculator from our site and directly onto your blog or website. Adjust the lump sum payment regular contribution figures term and annual interest rate. A n is the amount after n years future value.

A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. To begin your calculation take your daily interest.

The basic formula for Compound Interest is. Daily compound interest is calculated using a simplified version of the formula for compound interest. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

I also made a Compound Interest Calculator that uses these formulas. In addition you can include negative interest rates and inflation increases as part of your calculation. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings.

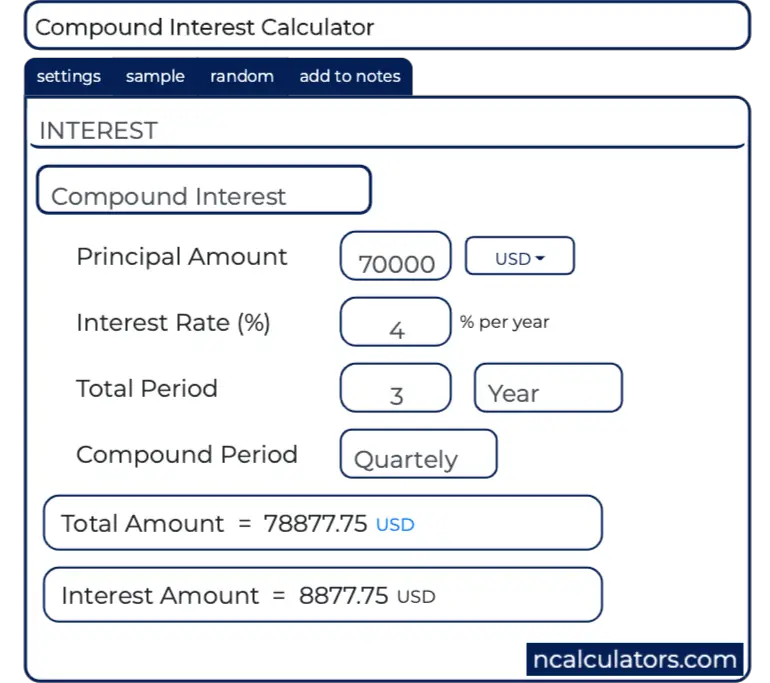

This compounding interest calculator shows how compounding can boost your savings over time. The image size calculator exactly as you see it above is 100 free for you to use. The essential factors of calculating compound interest are principal interest rate and frequency of compounding in a given duration.

To calculate compound interest we use this formula. When you do this the widget appears as a handsome calculator that your readers can use to compute elapsed time as well. Compound interest P 1rn nt - P.

FV represents the future value of the investment. How to Use the Compound Interest Calculator. The power of compound interest means you earn interest on interest.

Daily monthly quarterly half-yearly and yearly compounding. Simply enter the details of the principal amount interest rate period and frequency to know the interest earned. PV represents the present value of the investment.

That amount is compounded quarterly for the number of quarters remaining before the end of the three-year period. A 0 is the initial amount present value. Compound interest is a powerful force for people who want to build their savings.

A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account. Calculator Pro offers for free a widget for car professionals and those who test-drive cars.

You can calculate based on daily monthly or yearly. The above calculator compounds interest monthly after each deposit is made. FV PV x 1 in where.

At the end of the first year youd have 110 100 in principal 10 in interest. Range of interest rates above and below the rate set above that you desire to see results for. Based on Principal Amount of 1000 at an interest rate of 75 over 10 years.

For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually. Online Compound Interest Calculator - Use ClearTax compound interest calculator to calculate compound interest earned daily weekly monthly quarterly annually. P is principal or the original deposit in bank account.

How to calculate daily compound interest. Say you have an investment account that increased from 30000 to 33000 over 30 months. Compound Interest Interest that is added to the principal of a deposit resulting in interest earning interest.

With Compound Interest you work out the interest for the first period add it to the total and then calculate the interest for the next period. T is the number of years. Simply enter the details of the principal amount interest rate period and compounding frequency to know the.

R is the annual interest rate.

3 Ways To Calculate Daily Interest Wikihow Calculator Interest Calculator Microsoft Excel

Compound Interest Ci Formulas Calculator

Compound Interest Formula And Financial Calculator Excel Template

Loan Calculator Web App Design And Development Web App Design Calculator Design App Design

Compound Interest Ci Formulas Calculator

Compound Interest Formula And Financial Calculator Excel Template

How Can I Calculate Compounding Interest On A Loan In Excel

Compound Interest Formula In Excel In Easy Steps

Excel Savings Interest Calculator Personal Tools Simple Compound Interest Savings Tracker Spreadsheet Printable Savings Sheet

Compound Interest Calculator For Excel

Periodic Compound Interest Calculator

Compound Interest Calculator With Formula

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Calculator Interest Calculator Compound Interest Investing Money

Compound Interest Formula Explained Compound Interest Compound Interest Investments Math Methods

Daily Compound Interest Calculator Inch Calculator

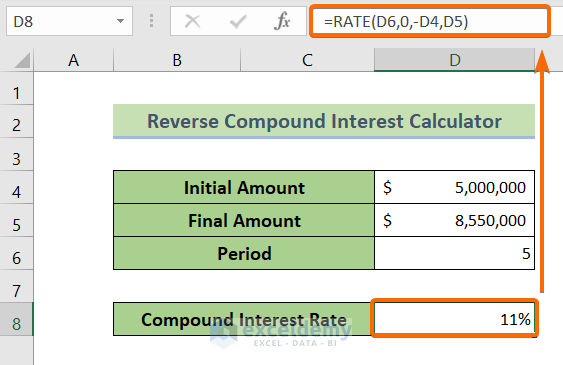

Reverse Compound Interest Calculator In Excel Download For Free